Part A

The Budget proposals for 2021-22 rest on 6 pillars:

- Health and Wellbeing

- Physical & Financial Capital, and Infrastructure

- Inclusive Development for Aspirational India

- Reinvigorating Human Capital

- Innovation and R&D

- Minimum Government and Maximum GovernanceHealth and Wellbeing

- Substantial increase in investment in Health Infrastructure

- Focus on strengthening three areas: Preventive, Curative, and Wellbeing

- Budget outlay for Health and Wellbeing was Rs 2,23,846 crore in BE 2021-22 as against this year’s BE of Rs 94,452 crore.

- Health Systems Strengthening:

- A new centrally sponsored scheme, PM AtmaNirbhar Swasth Bharat Yojana, will be launched with an outlay of about Rs 65,500 crore over 6 years in addition to NHM.

- The main interventions under the scheme are:

- Support for 17,788 rural and 11,024 urban Health and Wellness Centers

- Setting up integrated public health labs in all districts and 3382 block public health units in 11 states;

- Establishing critical care hospital blocks in 602 districts and 12 central institutions;

- Strengthening of the National Centre for Disease Control (NCDC), its 5 regional branches and 20 metropolitan health surveillance units;

- Expansion of the Integrated Health Information Portal to all States/UTs to connect all public health labs;

- Operationalisation of 17 new Public Health Units and strengthening of 33 existing Public Health Units at Points of Entry, that is at 32 Airports, 11 Seaports and 7 land crossings;

- Setting up of 15 Health Emergency Operation Centers and 2 mobile hospitals; and

- Setting up of a national institution for One Health, a Regional Research Platform for WHO South East Asia Region, 9 Bio-Safety Level III laboratories and 4 regional National Institutes for Virology.

Nutrition

- To strengthen nutritional content, delivery, outreach, and outcome, Mission Poshan 2.0 will be launched by merging the Supplementary Nutrition Programme and the Poshan Abhiyan

Universal Coverage of Water Supply

- The Jal Jeevan Mission (Urban) to be launched aims at universal water supply in all 4,372 Urban Local Bodies with 2.86 crore household tap connections, as well as liquid waste management in 500 AMRUT cities.

- It will be implemented over 5 years, with an outlay of Rs 2,79,500 crore

Swachch Bharat, Swasth Bharat

- The Urban Swachh Bharat Mission will be implemented with a total financial allocation of `1,41,678 crore over a period of 5 years from 2021-2026.

Clean Air

- To tackle air pollution, `2,217 crore for 42 cities with a million-plus population is proposed

Scrapping Policy

- A voluntary vehicle scrapping policy to phase out old and unfit vehicles

Vaccines

- Provision of Rs 35,000 crore for Covid-19 vaccine in BE 2021-22.

- The Pneumococcal Vaccine, a Made in India product, presently limited to only 5 states, will be rolled out across the country which will avert 50,000 child deaths annually.

- Physical and Financial Capital and Infrastructure

Production Linked Incentive scheme (PLI)

- Commitment of financial outlay of Rs 1.97 lakh crore in the next 5 years starting FY 2021-22 for PLI schemes in 13 Sectors

Textiles

- In addition to PLI, a scheme of Mega Investment Textiles Parks (MITRA) will be launched. Seven Textile Parks will be established over 3 years.

Infrastructure

- The National Infrastructure Pipeline (NIP) announced in December 2019 with 6835 projects has now expanded to 7,400 projects.

- Around 217 projects worth Rs 1.10 lakh crore under some key infrastructure Ministries have been completed.

- The NIP will require a major increase in funding both from the government and the financial sector. Following three steps are proposed to be undertaken to achieve this:

i. Creation of institutional structures;

ii. Big thrust on monetizing assets, and

iii. Enhancing the share of capital expenditure

- i. Creation of institutional structures :Infrastructure Financing

- A Bill to set up a Development Financial Institution (DFI) to act as a provider, enabler and catalyst for infrastructure financing

- Provision of Rs 20,000 crore to capitalise DFI.

- Aim to have a lending portfolio of at least Rs 5 lakh crore in three years.

- Suitable amendments in the relevant legislations of InVITs and REITs to enable Debt Financing by Foreign Portfolio Investors

ii. Big thrust on monetising assets

- Launch of a “National Monetisation Pipeline”

- Some important measures are:

- National Highways Authority of India and PGCIL each have sponsored one InvIT

- Railways to monetise Dedicated Freight Corridor assets for operations and maintenance, after commissioning

- The next lot of Airports will be monetised for operations and management concession.

iii.Sharp Increase in Capital Budget

- Sharp increase in capital expenditure with BE of Rs 5.54 lakh crore, 35% more than the BE of 2020-21.

- More than Rs 44,000 crore kept in the Budget of the Department of Economic Affairs to provide for projects/programmes/departments that show good progress on Capital Expenditure and are in need of further funds.

- Further, more than Rs 2 lakh crore to States and Autonomous Bodies for their Capital Expenditure.

- Roads and Highways Infrastructure

- The highest ever outlay of Rs 1,18,101 lakh crore for Ministry of Road Transport and Highways, of which `1,08,230 crore is for capital,

- Award of construction of more than 13,000 km length of roads, at a cost of Rs 3.3 lakh crore under the Rs 5.35 lakh crore Bharatmala Pariyojana project of which 3,800 km have been constructed.

- By March 2022, another 8,500 km will be awarded for construction and complete an additional 11,000 km of national highway corridors.

Railway Infrastructure

- An outlay of `1,10,055 crore, for Railways of which `1,07,100 is for capital.

- National Rail Plan for India – 2030 to create a ‘future ready’ Railway system by 2030.

- Western Dedicated Freight Corridor (DFC) and Eastern DFC to be commissioned by June 2022, will bring down the logistic costs thereby enabling Make in India strategy. The following additional initiatives are proposed:

- The Sonnagar – Gomoh Section (263.7 km) of Eastern DFC will be taken up in PPP mode in 2021-22.

- Future dedicated freight corridor projects namely East Coast corridor from Kharagpur to Vijayawada, East-West Corridor from Bhusaval to Kharagpur to Dankuni and North-South corridor from Itarsi to Vijayawada.

- Broad Gauge Route Kilometers (RKM) electrification to reach 46,000 RKM i.e., 72% by end of 2021

- 100% electrification of Broad-Gauge routes will be completed by December, 2023.

- For Passenger convenience and safety the following measures are proposed:

- Aesthetically designed Vista Dome LHB coach on tourist routes for better travel

- High density network and highly utilized network routes will have an indigenously developed automatic train protection system to eliminates train collision due to human error

Urban Infrastructure

- Expansion of metro rail network and augmentation of city bus service.

- A new scheme of Rs 18,000 crore will be launched to support augmentation of public bus transport services. The scheme will boost the automobile sector, provide fillip to economic growth, create employment opportunities for our youth and enhance ease of mobility for urban residents.

- Two new technologies i.e., ‘MetroLite’ and ‘MetroNeo’ will be deployed to provide metro rail systems at much lesser cost with same experience, convenience and safety in Tier-2 cities and peripheral areas of Tier-1 cities.

Power Infrastructure

- In past 6 years, 139 Giga Watts of installed capacity & 1.41 lakh circuit km of transmission lines have been added , an additional 2.8 crore households have been connected with water

- Consumers will have alternatives to choose the Distribution Company for enhancing competitiveness.

- Revamped reforms-based result-linked power distribution sector scheme will be launched with an outlay of `3,05,984 crore over 5 years.

- A comprehensive National Hydrogen Energy Mission 2021-22 will be launched

Ports, Shipping, Waterways

- Major Ports will offer 7 projects worth more than `2,000 crore Public Private Partnership mode in FY21-22.

- Subsidy support worth Rs 1624 crore over 5 years to Indian shipping companies in global tenders floated by Ministries and CPSEs.

- Recycling capacity of around 4.5 Million Light Displacement Tonne (LDT) will be doubled by 2024to generate an additional 1.5 lakh jobs.

Petroleum & Natural Gas

- Ujjwala Scheme will be extended to cover 1 crore more beneficiaries

- To add 100 more districts in next 3 years to the City Gas Distribution network.

- A gas pipeline project will be taken up in UT of J&K

- An independent Gas Transport System Operator will be set up

Financial Capital

- To consolidate the provisions of SEBI Act, 1992, Depositories Act, 1996, Securities Contracts (Regulation) Act, 1956 and Government Securities Act, 2007 into a rationalized single Securities Markets Code by the 75th year of independence.

- Support for development of a world class Fin-Tech hub at the GIFT-IFSC.

- To develop an investor charter as a right of all financial investors.

Increasing FDI in Insurance Sector

- To increase the permissible FDI limit from 49% to 74% and allow foreign ownership and control with safeguards.

Stressed Asset Resolution by setting up a New Structure

- To set up an Asset Reconstruction Company Limited and Asset Management Company

Recapitalization of PSBs

- Rs 20,000 crore is proposed in 2021-22.

Deposit Insurance

- Amendments to the DICGC Act, 1961 so that depositors can get easy and time-bound access to their deposits to the extent of the deposit insurance cover.

- Minimum loan size eligible for debt recovery under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002 is proposed to be reduced from the existing level of Rs 50 lakh to Rs 20 lakh.

Company Matters

- To decriminalise the Limited Liability Partnership (LLP) Act, 2008.

- To revise the definition for Small Companies by increasing their thresholds for Paid up capital from “not exceeding `50 Lakh” to “not exceeding `2 Crore” and turnover from “not exceeding `2 Crore” to “not exceeding `20 Cr”.

- To incentivize the incorporation of One Person Companies (OPCs) by allowing OPCs to grow without any restrictions on paid up capital and turnover

- To ensure faster resolution of cases, NCLT framework will be strengthened, e-Courts system shall be implemented and alternate methods of debt resolution and special framework for MSMEs shall be introduced.

- Launch of MCA21 Version 3.0

Disinvestment and Strategic Sale

- Strategic disinvestment of BPCL, Air India, Shipping Corporation of India, Container Corporation of India, IDBI Bank, BEML, Pawan Hans, Neelachal Ispat Nigam limited etc. to be completed in 2021-22.

- Other than IDBI Bank, two Public Sector Banks and one General Insurance company will be privatized.

- IPO of LIC

- NITI to work out on the next list of CPSEs to be taken up for strategic disinvestment.

- To incentivise States to take to disinvestment of their Public Sector Companies,

- Propose to create a Special Purpose Vehicle in the form of a company to monetize idle land

- A revised mechanism that will ensure timely closure of such units.

- Rs 1,75,000 crore as receipts from disinvestment in BE 2020-21 .

Government Financial Reforms

- On the recommendation of the Fifteenth Finance Commission, steps are being taken to rationalise and bring down the number of Centrally Sponsored Schemes.

3. Inclusive Development for Aspirational India

Agriculture

- Ensured that MSP is at least 1.5 times the cost of production across all

- Steady increase in the procurement

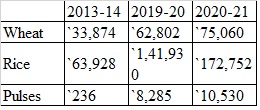

- Payment to farmers is as under:

(Rs in crore)

- Launch of SWAMITVA Scheme to provide a record of rights to property owners in villages. About 1.80 lakh property-owners in 1,241 villages have been provided cards.

- To extend this to cover all states/UTs.

- Enhance agricultural credit target to `16.5 lakh crores in FY22. We will focus on ensuring increased credit flows to animal husbandry, dairy, and fisheries.

- Enhancement of the Rural Infrastructure Development Fund from Rs 30,000 crores to Rs 40,000 crore.

- To double the Micro Irrigation Fund to Rs 10,000 crore

- To boost value addition in agriculture and allied products and their exports, the scope of ‘Operation Green Scheme’ will be extended to 22 perishable products.

- Around 1.68 crore farmers are registered and Rs 1.14 lakh crore of trade value has been carried out through e-NAMs. 1,000 more mandis will be integrated with e-NAM to bring transparency and competitiveness.

- The Agriculture Infrastructure Funds to APMCs for augmenting infrastructure facilities.

Fisheries

- To propose substantial investments in the development of modern fishing harbours and fish landing centres.

- To develop 5 major fishing harbours – Kochi, Chennai, Visakhapatnam, Paradip, and Petuaghat –as hubs of economic activity.

- To promote seaweed cultivation as emerging sector, a Multipurpose Seaweed Park to be established in Tamil Nadu.

Migrant Workers and Labourers

- Launched One Nation One Ration Card scheme for beneficiaries to claim rations anywhere in the country. Migrant workers to benefit the most.

- Portal for migrant workers to collect relevant information to formulate schemes for benefit of the workers.

- Implementation of the 4 labour codes for extending social security benefits to gig and platform workers with application of minimum wages all categories of workers

- Coverage under the Employees State Insurance Corporation to all workers

- Women will be allowed to work in all categories and also in the night-shifts with adequate protection

- Compliance burden on employers will be reduced with single registration and licensing, and online returns.

Financial Inclusion

- Under the scheme of Stand Up India for SCs, STs, and women margin money requirement reduced to 15% and to include loans for activities allied to agriculture in this category.

- Doubled the budget of MSME Sector to `15,700 crore

- Reinvigorating Human Capital

School Education

- To strengthen more than 15,000 schools qualitatively, all components of the National Education Policy will be implemented. They shall emerge as exemplar schools in their regions, handholding and mentoring other schools to achieve the ideals of the Policy.

- To set up 100 new Sainik Schools in partnership with NGOs/private schools/states.

Higher Education

- In order to provide light regulation as recommended under the NEP 2020, I propose to set up a Higher Education Commission of India, as an umbrella body having 4 separate vehicles for standard-setting, accreditation, regulation, and funding.

- Glue grant to create umbrella structure for better synergy amongst various research institutions, universities, and colleges of a city supported by Govt.

- Such umbrella structure in 9 cities

- To set up a Central University in Leh for accessibility of higher education.

Scheduled Castes and Scheduled Tribes Welfare

- Target of establishing 750 Eklavya model residential schools in tribal areas.

- To increase the unit cost of each such school from Rs 20 crore to Rs 38 crore, and for hilly and difficult areas, to `48 crores.

- This will create robust infrastructure facilities for our tribal students.

- Revamped the Post Matric Scholarship Scheme, for the welfare of Scheduled Castes with an outlay of Rs 35,219 crore for 6 years till 2025-2026, to benefit 4 crore SC students.

Skilling

- To amend the Apprenticeship Act with a view to enhance apprenticeship opportunities for our youth.

- To realign the existing scheme of National Apprenticeship Training Scheme (NATS) with an outlay of `3000 crore for providing post-education apprenticeship, training of graduates and diploma holders in Engineering.

- An initiative is underway, in partnership with the United Arab Emirates (UAE), to benchmark skill qualifications, assessment, and certification, accompanied by the deployment of certified workforce.

- To have a collaborative Training Inter Training Programme (TITP) between India and Japan

- To take forward this initiative with many more countries.

- Innovation and R&D

- National Research Foundation with an outlay of Rs 50,000 crore, over 5 years will strengthen overall research ecosystem of the country

- Rs 1,500 crore for a proposed scheme to promote digital modes of payment.

- To undertake National Language Translation Mission (NTLM) for making available wealth of governance-and-policy related knowledge on the internet in major Indian languages.

- Minimum Government, Maximum Governance

- Already undertaken number of steps to bring reforms in the functioning of Tribunals in the last few years for speedy delivery of justice. Taking it further, to abolish six tribunals.

- Already introduced a National Commission for Allied Healthcare Professionals with a view to ensure transparent and efficient regulation of the 56 allied healthcare professions.

- To bring about transparency, efficiency and governance reforms in the nursing profession, The National Nursing and Midwifery Commission Bill will be introduced.

- To set up a Conciliation Mechanism and mandate its use for quick resolution of contractual disputes with CPSEs.

- Allocation of Rs 4,388 crore for first digital census in the history of India.

- A grant of Rs 300 crore to the Government of Goa for the diamond jubilee celebrations of the state’s liberation from Portuguese.

- To provide Rs 1,000 crore for the welfare of Tea workers especially women and their children in Assam and West Bengal through a special scheme.

Fiscal Position

- The fiscal deficit in RE 2020-21 is pegged at 9.5% of GDP, funded through Government borrowings, multilateral borrowings, Small Saving Funds and short term borrowings.

- The fiscal deficit in BE 2021-2022 is estimated to be 6.8% of GDP.

Part B

- Tax system has to be transparent, efficient, and should promote investments and employment in our country. At the same time it should put minimum burden on our tax payers.

Direct Tax Proposals

- Corporate tax rate was slashed to make it among the lowest in the world.

- The Dividend Distribution Tax was abolished.

- The burden of taxation on small taxpayers was eased by increasing rebates.

- The return filers saw a dramatic increase to 48 crore in 2020 from 3.31 crore in 2014.

- Introduction of Faceless Assessment and Faceless Appeal.

- Further simplification ofthe tax administration, litigation management, and to ease compliance.

Relief to Senior Citizens

- Exemption from filing income tax returns for senior citizens who only have pension and interest income.

Reduction in Time for Income Tax Proceedings

- Reduction in time-limit for re-opening of assessment to 3 years from the present 6 years. In serious tax evasion cases too, only where there is evidence of concealment of income of `50 lakh or more in a year, can the assessment be re-opened up to 10 years, after the approval of the Principal Chief Commissioner.

Setting up the Dispute Resolution Committee

- Through Vivad Se Vishwas Scheme until 30th January 2021, over 1 lakh taxpayers have opted to settle tax disputes of over `85,000 crores.

- A Dispute Resolution Committee for taxpayer with a taxable income up to `50 lakh and disputed income up to `10 lakh to ensure efficiency, transparency and accountability.

Faceless ITAT

- Establish a National Faceless Income Tax Appellate Tribunal Centre, all communication between the Tribunal and the appellant shall be electronic. Where personal hearing is needed, it shall be done through video-conferencing.

Relaxation to NRI

- Notifying rules for removing this hardship to NRIs regarding their foreign retirement accounts.

Exemption from Audit

- Increasing limit of turnover for tax audit to ₹10 crore from ₹5 crore.

Relief for Dividend

- Dividend payment to REIT/ InvIT exempt from TDS.

- Advance tax liability on dividend income shall arise only after the declaration/payment of dividend.

- For Foreign Portfolio Investors deduction of tax on dividend income at lower treaty rate.

Attracting foreign investment into infrastructure sector

- Relaxation of some conditions relating to prohibition on private funding, restriction on commercial activities, and direct investment in infrastructure sector.

- Infrastructure Debt Funds eligible to raise funds by issuing Zero Coupon Bonds.

Affordable Housing/Rental Housing

- Additional deduction of interest, amounting to `1.5 lakh shall for loans taken up till 31st March 2022, for the purchase of an affordable house.

- To increase the supply of houses,affordable housing projects can avail a tax holiday for one more year – till 31st March, 2022

- Tax exemption for notified Affordable Rental Housing Projects to promote supply of houses for migrant workers

Tax incentives to IFSC

- Tax holiday for capital gains from incomes of aircraft leasing companies.

- Tax exemptions for aircraft lease rentals paid to foreign lessors.

- Tax incentive for relocating foreign funds in the IFSC.

- Tax exemption to the investment division of foreign banks located in IFSC.

Pre-filling of Returns

- To ease filing of returns, details of capital gains from listed securities, dividend income, and interest from banks, post office, etc. will also be pre-filled in returns.

Relief to Small Trusts

- Exemption limit of annual receipt revised from ₹1 crore to ₹5 crore for Small charitable trusts running small schools and hospitals.

Labour Welfare

- To ensure that employees’ contributions are deposited on time, late deposit of employee’s contribution by the employer shall never be allowed as deduction to the employer.

Tax benefits for start-ups

- Eligibility for claiming tax holiday for start-ups extended till 31st March, 2022.

- The capital gains exemption for investment in start-ups extended till 31st March, 2022.

Indirect Tax Proposals

GST

- measures taken till date

- nil return through SMS

- quarterly return and monthly payment for small taxpayers

- electronic invoice system

- validated input tax statement

- pre-filled editable GST return

- staggering of returns filing.

Custom Duty Rationalization to promote domestic industry

- Twin objective, promoting domestic manufacturing and helping India get onto global value chain and export better.

- Review more than 400 old exemptions to put in place a revised customs duty structure, free of distortions.

- Any new customs duty exemption will have validity up to the 31st March following two years from the date of its issue.

Electronic and Mobile Phone Industry

- Withdrawal of few exemptions on parts of chargers and sub-parts of mobiles.

- Some parts of mobiles will move from ‘nil’ rate to a moderate 2.5%.

Iron and Steel

- Reduction of Customs duty uniformly to 7.5% on semis, flat, and long products of non-alloy, alloy, and stainless steels.

- Exempting duty on steel scrap for a period up to 31st March, 2022 to provide relief to metal re-cyclers.

- Revoking ADD and CVD on certain steel products.

- Reducing duty on copper scrap from 5% to 2.5% to provide relief to copper recylers.

Textile

- Uniform reduction of the BCD rates on caprolactam, nylon chips and nylon fiber& yarn to 5% to help the textile industry, MSMEs, and exports.

Chemicals

- Calibrated customs duty rates on chemicals to encourage domestic value addition and to remove inversions.

Gold and Silver

- Rationalization of custom duty on gold and silver.

Renewable Energy

- To notify a phased manufacturing plan for solar cells and solar panels.

- Raising duty on solar invertors from 5% to 20%, and on solar lanterns from 5% to 15% to encourage domestic production.

Capital Equipment

- Withdrawal of exemptions on tunnel boring machine. It will attract a customs duty of 7.5%; and its parts a duty of 2.5%.

- Raising customs duty on certain auto parts to 15% to bring them on par with general rate on auto parts.

MSME Products

- Increase duty from 10% to 15% on steel screws and plastic builder wares.

- On prawn feed we increase it from 5% to 15%.

- Rationalizing exemption on import of duty-free items as an incentive to exporters of garments, leather, and handicraft items. Most of these products are produced for MSMEs

- Withdrawing exemption on imports of certain kind of leathers.

- Raising customs duty on finished synthetic gem stones to encourage their domestic processing.

Agriculture Products

- Increasing customs duty on cotton from nil to 10% and on raw silk and silk yarn from 10% to 15%.

- Withdrawal of end-use based concession on denatured ethyl alcohol.

- Agriculture Infrastructure and Development Cess (AIDC) on a small number of items.

- Consequent to imposition of Agriculture Infrastructure and Development Cess (AIDC) on petrol and diesel, theBasic excise duty (BED) and Special Additional Excise Duty (SAED) rates have been reduced on them so that overall consumer does not bear any additional burden. Consequently, unbranded petrol and diesel will attract basic excise duty of Rs1.4, and Rs 1.8 per litre respectively. The SAED on unbranded petrol and diesel shall be Rs 11 and Rs 8 per litre respectively. Similar changes have also been made for branded petrol and diesel

- An agriculture Infrastructure and Development Cess (AIDC) of Rs 2.5 per litre has been imposed on petrol and Rs 4 per litre on diesel. Overall there would be no additional burden on the consumer.

Rationalization of Procedures and Easing of Compliance

- TurantCustoms initiative, a Faceless, Paperless, and Contactless Customs measures.

- New procedure for administration of Rules of Origin.

More Stories

‘Tippu NijaSwarupam’ Book Launch event organised in Hyderabad

Muslim cleric from AP calls for assassination of PM Modi and Amit Shah

Kerala Church Rebels Against New Worship Method Mandated by Pope